child tax credit 2021 dates irs

IR-2021-218 November 9 2021. WASHINGTON The IRS today issued a revised set of frequently asked questions for tax year 2021 and filing season 2022 for the Child Tax CreditThese frequently asked questions FAQs are released to the public in Fact Sheet 2022-28 PDF April 27 2022.

Irs Child Tax Credit Payments Start July 15

Tax Year 2019 Form 990EZ.

. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. Payments begin July 15 and will be sent monthly through December 15 without any further action required. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

Regular mail through the post office. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

How To Use The IRSs Update Portal July 14 2021 324 PM CBS Chicago CBS Philadelphia -- Advance payments of. The total of the advance payments will be up to 50 percent of the Child Tax Credit. It also provided monthly payments from July of 2021 to December of 2021.

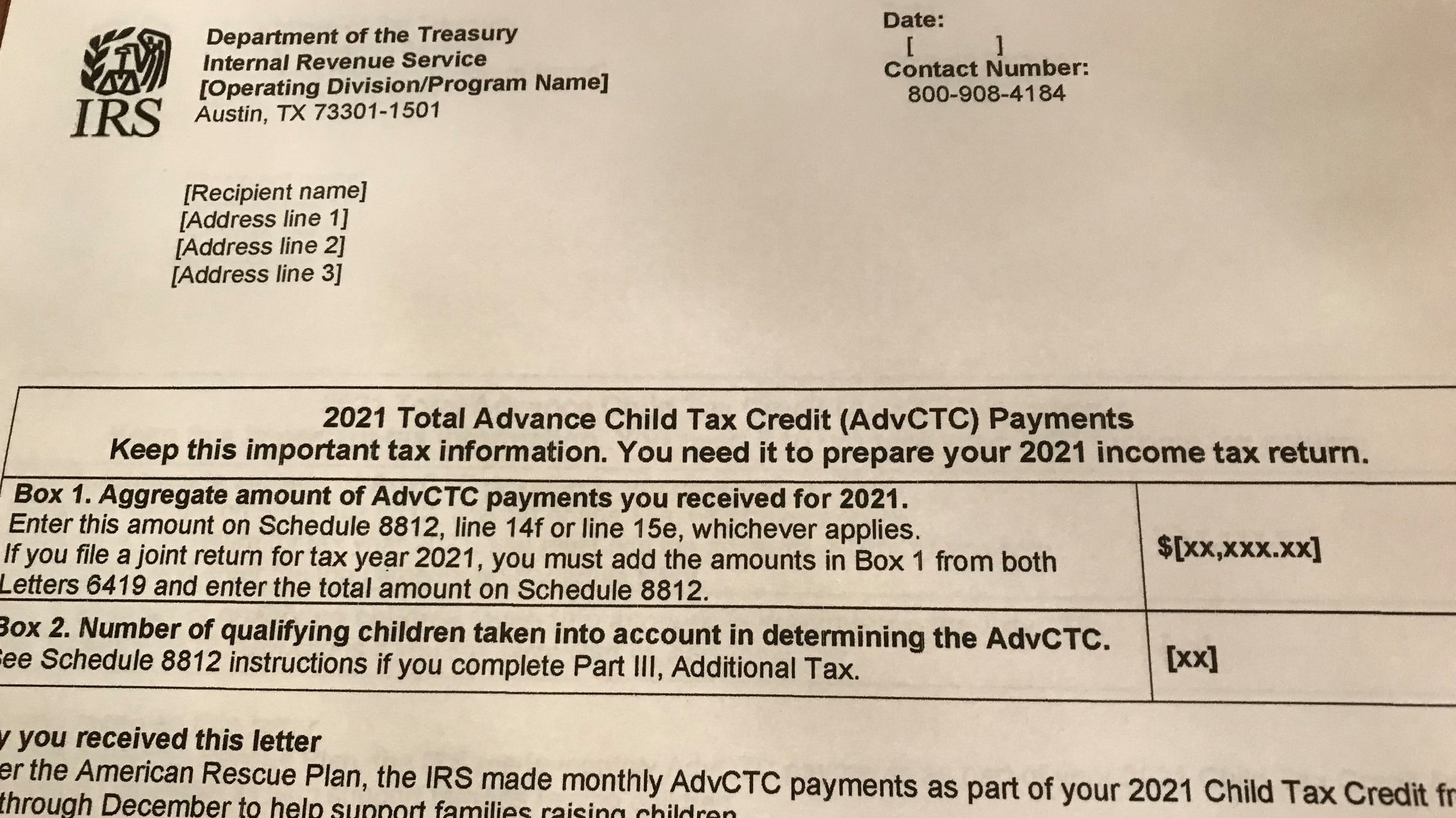

Under the American Rescue Plan the IRS disbursed half of the 2021 Child Tax Credit in monthly payments during the second half of 2021. Giac nguyen temple new jersey EIN. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may.

Tax Collector Township of Piscataway 455 Hoes Lane Piscataway NJ 08854 732 562-2331. The 500 nonrefundable Credit for Other Dependents amount has not changed. ACH payments using your checking accounts do not incur transaction fees.

3600 for children ages 5 and under at the end of 2021. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Learn more about the Advance Child Tax Credit.

Find COVID-19 Vaccine Locations With. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. Families will receive the entire 2021 Child Tax Credit that they are.

Advance payments of the 2021 Child Tax Credit will be made regularly from July through December to eligible taxpayers who have a main home in the United States for more than half the year. When you file your 2021 tax return you can claim the other half of the total CTC. Electronic copies images of Forms 990 990-EZ 990-PF or 990-T returns filed with the IRS by charities and non-profits.

3000 for children ages 6 through 17 at the end of 2021. Commonly Asked Filing Season Questions Questions 1 through 6. WASHINGTON The Internal Revenue Service today updated frequently-asked-questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit Payments to describe how taxpayers can now provide the IRS an estimate of your 2021 income using the Child Tax Credit Update Portal CTC UP.

Katrena Ross started receiving 300 a month last July as part of the expanded monthly child tax credit payments. This first batch of advance monthly payments worth roughly 15 billion. In the case of Feigh vCommissioner 152 TC No.

For both age groups the rest of the payment. The revision adds Topic F. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

Child Tax Credit Latest. The updated Child Tax Credit may provide some relief. IRSgovchildtaxcredit2021 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above.

Starting July 15 2021 the Internal Revenue Service IRS will pay most parents up to 300 per month per child. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. The IRS bases your childs eligibility on their age on Dec.

31 2021 so a 5-year. The IRS bases your childs eligibility on their age on Dec. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax.

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. IR-2021-153 July 15 2021. There is a transaction fee of 290 for credit card transactions.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

15 the IRS was found to have effectively created an unintended double tax benefit for receipt of a Medicaid waiver payment for care of a taxpayers adult disabled childrenThe Court found that the plain language of IRC 131 did not support the conclusion the IRS arrived at in Notice 2014-7 which treated such a. The IRS said it will update its Child Tax Credit Update Portal later this year to allow parents to register children born or adopted in 2021. The Michigan mother of three including a son with autism used the money to pay.

For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. Know the questions to ask.

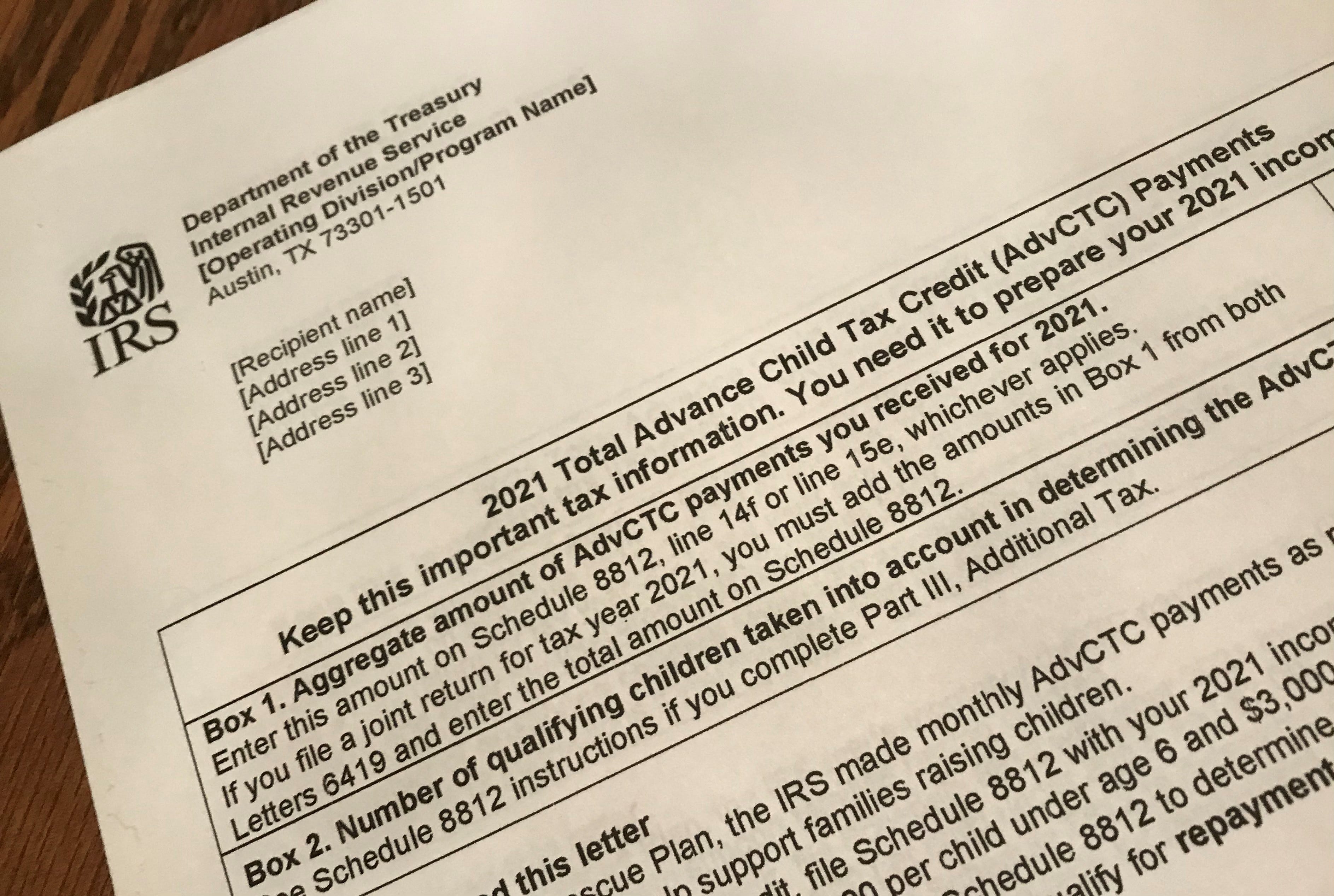

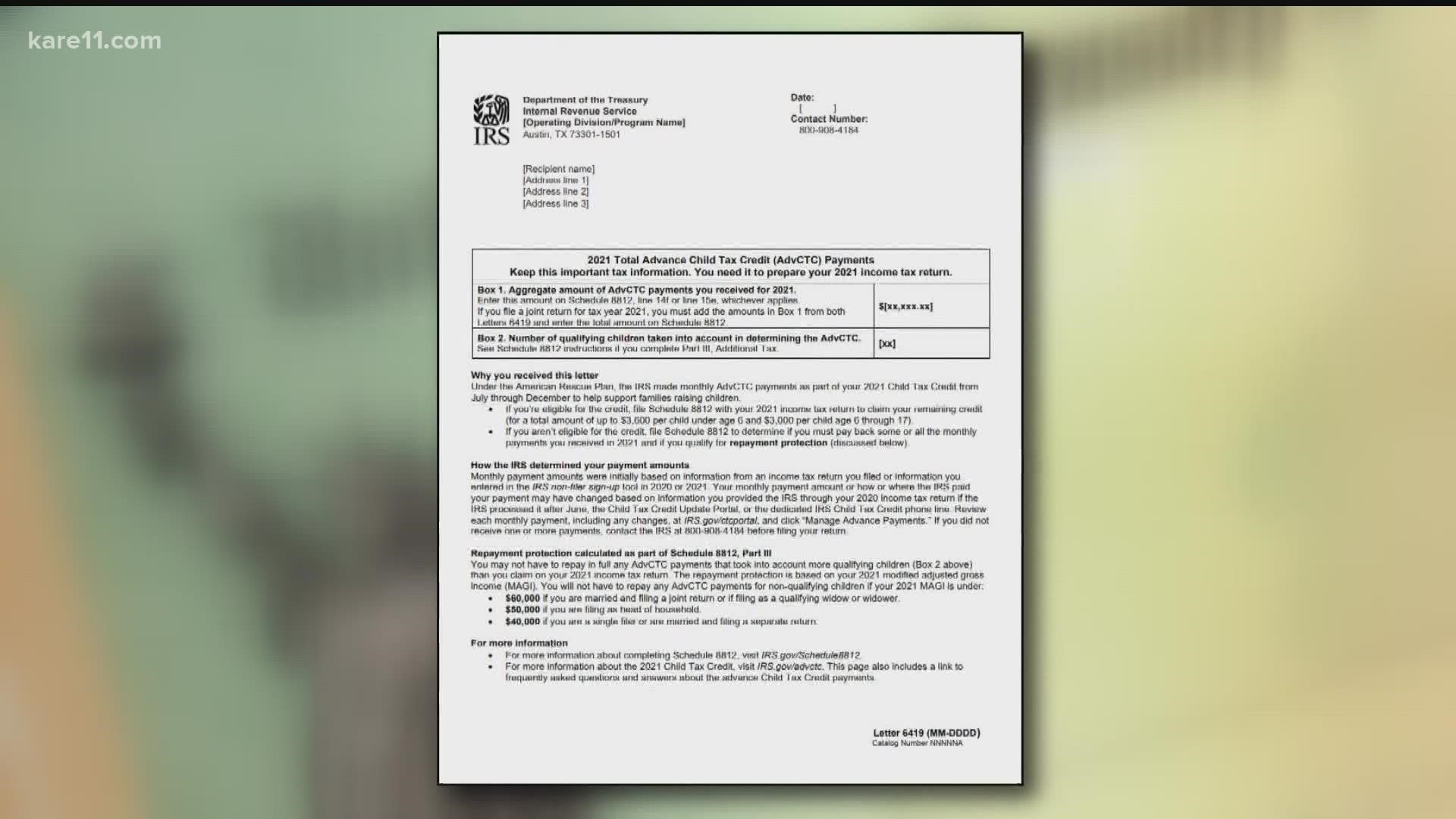

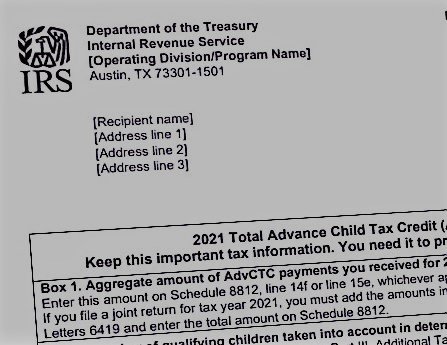

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kokh

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data Irs Tax Forms Irs Taxes Irs Forms

2021 Child Tax Credit Advanced Payment Option Tas

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Irs Cp 08 Potential Child Tax Credit Refund

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com